The Single Strategy To Use For Loss Adjuster

How Property Damage can Save You Time, Stress, and Money.

Table of ContentsRumored Buzz on Property DamageGetting The Loss Adjuster To Work3 Simple Techniques For Property Damage

A public insurance adjuster is an independent insurance policy professional that a policyholder might work with to assist clear up an insurance coverage claim on his or her behalf. Your insurance provider gives an adjuster at on the house to you, while a public adjuster has no connection with your insurance provider, as well as charges a cost of as much as 15 percent of the insurance settlement for his/her services.

If you're considering hiring a public adjuster: of any kind of public adjuster. Request for suggestions from household and affiliates - property damage. See to it the insurance adjuster is licensed in the state where your loss has actually occurred, and also call the Bbb and/or your state insurance coverage department to check out his or her document.

Your state's insurance coverage division may set the percent that public insurance adjusters are permitted fee. Watch out for public insurers who go from door-to-door after a catastrophe. property damage.

Savings Contrast rates and also minimize home insurance today! When you sue, your property owners insurance provider will certainly assign an insurance claims insurer to you. The adjuster's task is to evaluate your residential property damage and establish a fair payout amount based upon the degrees of coverage you bring on your policy.

Public Adjuster for Dummies

Like a cases insurer, a public insurance adjuster will certainly assess the damages to your residential property, assistance establish the range of repairs and also approximate the substitute value for those repairs. The big distinction is that as opposed to functioning on behalf of the insurance provider like an insurance declares adjuster does, a public claims insurer benefits you.

The NAPIA Directory site lists every public adjusting company required to be licensed in their state of operation (property damage). You can enter your city as well as state or ZIP code to see a listing of insurers in your location. The other means to locate a public insurance adjuster is to obtain a suggestion from pals or member of the family.

Checking out on-line client reviews can additionally be practical. Once you locate a few challengers, learn just how much they charge. The majority of public adjusters maintain a percent of the last insurance claim payment. Maybe as little as 5 percent and as high as 20 percent. If you are dealing with a huge claim with a possibly high payout, consider the price prior to picking to hire a public insurance adjuster.

The 3-Minute Rule for Property Damage

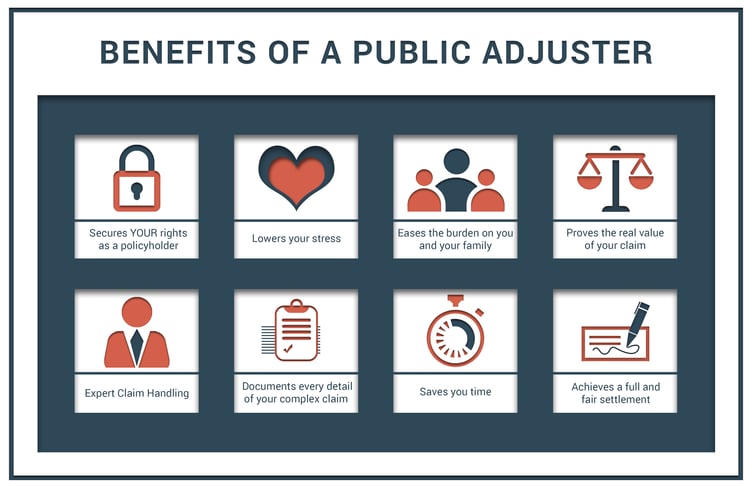

To vouch for this commitment, public insurers are not paid up front. Instead, they obtain a percent of the negotiation that they acquire in your place, as managed by your state's department of insurance. An experienced public insurance adjuster works to achieve several jobs: Understand and analyze your insurance coverage policy Promote your legal rights throughout your insurance coverage case Precisely and also thoroughly analyze as well as value the range of the residential or commercial property damage Apply all policy provisions Discuss an optimized negotiation in an effective and also effective manner Collaborating with a skilled public adjuster is one of the very best methods to get a rapid and also reasonable settlement on your insurance claim.

Your insurance coverage company's representatives are not always going to look to reveal all of your losses, seeing as it isn't their duty or in their ideal passion. Provided that your go to this website insurance firm has an expert functioning to safeguard its passions, shouldn't you do the exact same? A public insurance adjuster can work with various sorts of cases on your part: We're usually inquired about when it makes sense to hire a public insurance claims insurance adjuster.

The bigger and a lot more intricate the claim, the a lot more most likely it is that you'll require expert aid. Working with a public adjuster can be the best selection for various sorts of property insurance coverage cases, especially when the risks are high. Public insurers can aid with a variety of beneficial jobs when navigating your insurance claim: Interpreting policy language and determining what is covered by your service provider look at this site Performing a complete evaluation of your insurance coverage Taking right into account any current adjustments in building regulations as well as legislations that might supersede the language of your policy Completing a forensic assessment of the residential property damages, often uncovering damage that can be or else difficult to find Crafting a tailored prepare for obtaining the ideal settlement from your building insurance coverage claim Recording as well as valuing the full extent of your loss Putting together photographic evidence to support your case Handling the daily jobs that usually come with suing, such as interacting with the insurer, participating in onsite conferences as well as submitting documents Offering your insurance claims package, consisting of supporting documentation, to the insurance firm Skillfully negotiating with your insurance provider to make certain the largest negotiation possible The most effective part is, a public claims adjuster can get involved at any type of factor in the claim declaring procedure, from the minute a loss takes place to after an insurance policy claim has actually currently been paid or rejected.